Are you ready to embark on a thrilling and rewarding journey into the world of Share Market? The stock market is also commonly referred to as the “equity market” “capital market” “securities market” “public market” or the “share market.” These names are often used interchangeably and refer to the same concept of a marketplace where stocks or shares of publicly traded companies are bought and sold.

Whether you’re a complete beginner or looking to sharpen your skills, this comprehensive guide is designed to make the complex world of stocks and investments as simple.

This easy-to-follow, beginner-friendly guide will cover everything you need to know from A to Z. By the time you’ve finished this article, you’ll not only understand how the Share Market works but you’ll also be inspired and motivated to embark on your very own investment journey.

So what are you waiting for? Let’s get started on this incredible adventure and unlock the secrets of the Share Market together! Remember, we’re here to guide you every step of the way, making complex concepts as easy as ABC, so that even a child can understand.

Share Market History

Once upon a time, in a land filled with people who wanted to make their money grow, there was a magical place called the Share Market. This place, also known as the Stock Market, is like a huge playground where people buy and sell little pieces of companies called “shares” or “stocks.” We are going to take you on a journey through the history of the Share market and how the Share market works.

A long, long time ago, around the 12th century, people in Europe were busy trading goods like grains, clothes, and other items. They needed a place where they could come together to buy and sell their products. This gathering place was called a “market.”

Now, imagine a big playground, where you and your friends come to play and exchange toys. The Share market is similar to that playground, but instead of toys, people trade “shares” of companies.

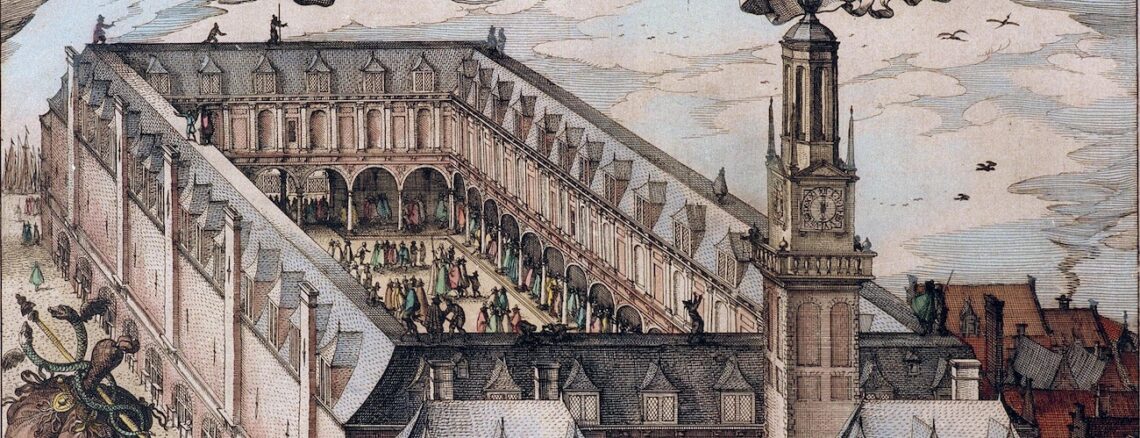

The very first Share market was established in Antwerp, Belgium, in the 1400s and 1500s. It was like a big fair, where people gathered to trade shares of different companies. This was the beginning of what we now know as the “stock market.”

As time passed, more and more countries started their own Share markets. In 1602, the Amsterdam Stock Exchange was created, which was the world’s first official stock exchange. the Dutch East India Company became the first company to issue shares to the public. This event marked the birth of the modern-day stock market.

Now, let’s fast forward to the 18th century when another important stock exchange was created in a city called London. The London Stock Exchange became a popular place for people to buy and sell shares. Soon, other countries also started their own stock exchanges, such as the New York Stock Exchange in the United States.

As more and more people began to trade shares, they started to notice patterns in the way share prices changed. For example, they observed that when a company was doing well, its share price would usually go up. On the other hand, when a company was struggling, its share price would often go down. This led to the creation of a new field called “technical analysis” which is like being a detective and trying to predict the future by studying these patterns.

In the 20th century, the Share Market went through some ups and downs. There were times when the prices of shares went up very quickly, like a balloon soaring into the sky. This was called a “bull market.” However, there were also times when the prices of shares went down very fast, like a roller coaster plunging down a steep hill. This was called a “bear market.”

During this period, many important events happened that changed the Share Market forever. One of these events was the Great Depression in the 1930s. This was a very sad time when many people lost their jobs and businesses went bankrupt. The Share Market crashed and it took many years for it to recover.

Another important event was the introduction of computers in the 1980s. Before this people had to trade shares by shouting and waving their hands in the crowded stock exchange. But with computers, they could now trade shares at lightning speed, right from the comfort of their homes!

Today, the Share Market is a global playground where millions of people from all around the world come together to buy and sell shares. With the help of technology, we can now trade shares with just a few clicks on our smartphones or computers. The Share Market has come a long way since its humble beginnings in the Netherlands, and it continues to be an exciting place where dreams can come true and fortunes can be made.

And that, my dear friend, is the story of the Share Market. I hope this tale has helped you understand how this magical place came to be and how it works. Just remember, the Share Market can be like a roller coaster ride, full of ups and downs, so always be cautious and never invest more than you can afford to lose.

what is the Share Market?

Imagine you’re walking through a magical forest, and you come across a tree with golden leaves. You’ve heard that these golden leaves have the power to grow your wealth. You’re intrigued and want to know more about this magical tree and its leaves. The Share Market is just like that magical forest, and the golden leaves are the shares or stocks of different companies.

So, what is the Share Market? It’s a place where people buy and sell small pieces of companies called “shares” or “stocks.” When you buy a share, you become a part-owner of that company. Your share of ownership can grow or shrink depending on how well the company is doing.

Now, let’s say you’re at a birthday party, and you’ve been given a big, delicious cake to share with your friends. You decide to cut the cake into small pieces so that everyone can have a slice. Each slice represents a share of the cake. If the cake is the company, then each slice (or share) represents a small part of the company’s ownership.

But why would people want to buy and sell these shares? Well, when a company does well, the value of its shares can increase. So, if you bought a share when it was worth $10 and later sold it for $15, you would make a $5 profit. This is one of the main reasons people invest in the Share Market – to make their money grow.

Now, you might be wondering, how do people know which stocks to buy and when to sell them? Remember, knowledge is power, and the more you know about the Share market, the better decisions you can make about your investments. That’s why it’s important to first understand the basics of the Share market and how it works.

How Does Stock Market Work

Alright, let’s dive into how the Share Market works. Picture a bustling marketplace where people come to buy and sell all kinds of goods. The Share Market is just like that, except instead of buying and selling fruits, vegetables, or clothes, people trade shares of companies. These shares represent small pieces of ownership in a company.

To help you understand how the Share Market works, let’s imagine a simple story.

There are two friends named Alice and Bob. Alice has a successful lemonade stand business, and she wants to expand her business to other neighborhoods. To do this, she needs more money to buy supplies and hire helpers. So, Alice decides to sell shares of her lemonade stand business to raise the funds she needs.

Bob, who is always looking for ways to grow his money, hears about Alice’s plan and decides to buy some shares of her lemonade stand business. By doing this, he becomes a part-owner of the business. If Alice’s lemonade stand does well and makes more money, the value of Bob’s shares will likely increase. On the other hand, if the business struggles, the value of his shares might decrease.

This is the basic idea behind the Share Market – it’s a place where people like Alice and Bob can buy and sell shares of different companies. There are many factors that can affect the value of a company’s shares, such as the company’s performance, overall market conditions, news about the company or its industry, etc.

What is a Stock Exchange & its Meaning

we learned about how the Share Market works using the story of Alice and her lemonade stand business. Now, let’s explore the next step, which is understanding “stock exchanges.”

Think of a stock exchange as a big, organized marketplace where shares of different companies are bought and sold. Just like a regular marketplace has different stalls for fruits, vegetables, and clothes, a stock exchange has different “stalls” (called “listings”) for the shares of various companies. These stock exchanges make it easy for people like Bob to buy shares from people like Alice.

There are many stock exchanges around the world, each with its own unique features and rules. Some of the most famous stock exchanges include the New York Stock Exchange (NYSE) in the United States, the London Stock Exchange (LSE) in the United Kingdom, and the Tokyo Stock Exchange (TSE) in Japan. Companies can choose to list their shares on one or more stock exchanges, depending on their size, location, and other factors.

Now, let’s go back to our story about Alice and her lemonade stand business. To raise money for her business expansion, Alice decides to list her shares on a stock exchange. This way, people like Bob can easily buy and sell these shares. The stock exchange also helps Alice set an initial price for her shares, based on factors like the value of her business and the demand for her shares.

Once Alice’s shares are listed on the stock exchange, Bob can use his computer or smartphone to place an order to buy them. When someone else is willing to sell their shares at the price Bob is offering, the transaction is completed, and the shares change hands. This process happens very quickly, sometimes in just a fraction of a second!

Types of Markets in the Stock Market

Now, let’s take the next step and explore the different types of markets that make up the Stock Market.

There are mainly two types of markets in the Share Market: the primary market and the secondary market. These markets serve different purposes and help investors in different ways. Let’s understand each one with the help of examples.

Primary Market

The primary market is where companies issue new shares to the public for the first time. This process is called an Initial Public Offering (IPO).

In our story about Alice and her lemonade stand business, when Alice decided to sell shares of her business to raise funds for expansion, she entered the primary market. The primary market allows companies like Alice’s lemonade stand to raise money directly from investors by selling their shares. In return, investors become part-owners of the company.

For example, let’s say a new smartphone company wants to raise money to build a factory. They can issue an IPO in the primary market, where investors can buy shares of the company. The money raised from the sale of these shares will be used by the company to build the factory.

Secondary Market

The secondary market is where investors trade shares that have already been issued in the primary market. This is the market most people think of when they hear the term “Stock Market.”

Once Alice’s lemonade stand shares are listed on a stock exchange, people like Bob can buy and sell these shares in the secondary market. The secondary market allows investors to trade shares among themselves without involving the company that issued the shares.

For example, if Bob bought shares of the smartphone company in the primary market and later decided to sell them, he would do so in the secondary market. Another investor could then buy these shares from Bob, and the ownership of the shares would change hands.

As we continue our journey, we will delve deeper into the concept of Initial Public Offerings (IPOs) in the next part. IPOs play a crucial role in the primary market, allowing companies to issue new shares to the public for the first time and raise capital for their business ventures.

Explore The Concept of IPO

An Initial Public Offering (IPO) is a process through which a private company goes public by offering its shares for sale to the general public for the first time. This allows the company to raise capital to fund its growth, expansion, or other business objectives. In return, investors who buy shares in the IPO become part-owners of the company.

Let’s revisit the story of Alice and her lemonade stand business to better understand IPOs.

When Alice decides to expand her business, she needs more money to buy supplies and hire helpers. To raise these funds, Alice decides to go public by offering shares of her lemonade stand business through an IPO. Once the IPO is complete, Alice’s lemonade stand business will become a publicly traded company, and its shares will be listed on a stock exchange.

The IPO Process Involves Several Steps

The company works with an investment bank to help manage the IPO process, set the share price, and underwrite the offering.

The company creates a detailed document called a prospectus, which provides important information about the company, its finances, and the risks associated with investing in its shares.

The company must obtain approval from relevant regulatory authorities to ensure that the IPO complies with all applicable laws and regulations.

The investment bank and the company determine the initial share price and the number of shares to be offered. The shares are then allocated to institutional and individual investors.

Once the IPO is complete, the company’s shares are listed on a stock exchange, and investors can start buying and selling them in the secondary market.

We have explored the concept of Initial Public Offerings (IPOs) and their significance in the primary market. We learned that an IPO is a process through which a private company goes public by offering its shares for sale to the general public for the first time. This allows the company to raise capital to fund its growth, expansion, or other business objectives, while investors who buy shares in the IPO become part-owners of the company.

As we continue our journey into the world of the Share market, our next step is to learn about investing in stocks.

We will discuss the buying and selling of shares in the market and understand the role of brokers in facilitating transactions.

Buying/Selling Shares in the Stock Market

To buy or sell shares in the Share market, you need to understand the mechanics of trading stocks, which include placing orders, knowing the different types of orders, and working with brokers who facilitate these transactions.

let’s explain the process of buying and selling shares in the stock market using a story to help you better understand the concepts.

Meet Alice and Bob, two friends who have recently learned about the Share market and want to start investing. They decide to follow the steps mentioned earlier to begin their investment journey.

Choosing a broker

The first step in buying or selling shares is to choose a broker. A broker is a professional who acts as an intermediary between you and the stock exchange. They can be an individual or a firm, and they are responsible for executing your orders to buy or sell shares. Brokers typically charge a commission or fee for their services.

Alice and Bob research different brokers, comparing their services, fees, and reputation. They decide to choose “TrustyBroker,” a well-known brokerage firm with a user-friendly platform and reasonable fees.

Opening a trading account

After selecting a broker, you need to open a trading account, which is similar to a bank account but specifically designed for buying and selling shares.

Alice and Bob each open their own trading account with TrustyBroker. They submit the required documents and deposit some money into their accounts to start buying shares.

Placing orders

To buy or sell shares, you need to place an order through your broker. There are several types of orders, including:

1. Market Order: This is an order to buy or sell a stock immediately at the best available price. For example, if Alice wants to buy 10 shares of a company right away, she can place a market order, and the broker will execute the order at the current market price.

2. Limit Order: This is an order to buy or sell a stock at a specific price or better. For example, if Bob wants to buy 10 shares of a company but only if the price is $50 or lower, he can place a limit order. The broker will execute the order only if the stock reaches $50 or a lower price.

3. Stop Order: This is an order to buy or sell a stock once it reaches a specific price, known as the stop price. For example, if Alice wants to sell 10 shares of a company if the price falls to $40 or lower, she can place a stop order. The broker will execute the order once the stock reaches $40 or a lower price.

4. Limit Order: Bob also wants to sell some of his shares but only if the price reaches $40 or higher. He places a limit order to sell 10 shares at $40.

Monitoring investments

Alice and Bob regularly check their portfolios, read financial news, and stay updated on the performance of their invested companies. This helps them make informed decisions about buying or selling shares in the future.

We can see how Alice and Bob used different types of orders to buy and sell shares in the stock market according to their investment strategies. They worked with a broker, opened trading accounts, placed orders, and monitored their investments to achieve their financial goals.

Explore Different Stock Analysis Techniques

As we progress in our journey to understand the stock market, our next step will be to learn about various stock analysis methods. In this section, we will delve into different techniques used by investors use to make informed decisions about buying or selling shares. There are primarily three types of analysis: fundamental analysis, technical analysis, and quantitative analysis.

Fundamental Analysis

Fundamental analysis is a method used by investors to determine a company’s intrinsic value by analyzing its financial statements, business model, industry trends, and various other factors. This approach helps investors understand whether a stock is undervalued or overvalued compared to its actual worth.

For instance, Alice is interested in investing in a company called “EcoFriendly,” which specializes in sustainable products. To perform fundamental analysis, she examines the company’s financial statements, such as its income statement, balance sheet, and cash flow statement. Alice also considers the company’s management team, competitors, and overall industry growth. After her analysis, she determines that EcoFriendly’s stock is undervalued, and she decides to invest.

We will explore key points that should be considered during a comprehensive fundamental analysis. These points span different categories such as industry & market, company fundamentals, growth & profitability, valuation ratios, and more. Having a thorough understanding of these factors will enable investors to make well-informed investment decisions.

| Points | Category |

|---|---|

| Industry Analysis | Industry & Market |

| Company Business Model | Company Fundamentals |

| Financial Statements | Financial Health |

| Revenue Growth | Growth & Profitability |

| Profit Margin | Growth & Profitability |

| Earnings per Share (EPS) | Valuation Ratios |

| Price-to-Earnings (P/E) Ratio | Valuation Ratios |

| Dividend Yield | Dividends & Payout |

| Debt-to-Equity Ratio | Debt & Leverage |

| Current Ratio | Liquidity |

| Return on Equity (ROE) | Efficiency Ratios |

| Return on Assets (ROA) | Efficiency Ratios |

| Return on Investment (ROI) | Efficiency Ratios |

| Management Quality | Management Assessment |

| Competitive Advantage | Competitive Position |

| Market Share | Competitive Position |

| SWOT Analysis | Strategic Analysis |

| Growth Projections | Future Prospects |

| Regulatory Environment | External Factors |

| Macroeconomic Factors | External Factors |

| Book Value per Share | Valuation Ratios |

| Price-to-Sales (P/S) Ratio | Valuation Ratios |

| Price-to-Book (P/B) Ratio | Valuation Ratios |

| Gross Margin | Growth & Profitability |

| Operating Margin | Growth & Profitability |

| Cash Flow Analysis | Financial Health |

| Inventory Turnover | Efficiency Ratios |

| Asset Turnover | Efficiency Ratios |

| Capital Expenditures | Capital Allocation |

| Free Cash Flow | Financial Health |

| Enterprise Value (EV) | Valuation Ratios |

| EV/EBITDA Ratio | Valuation Ratios |

| Earnings Quality | Earnings Assessment |

| Insider Trading Activity | Ownership Analysis |

| Institutional Ownership | Ownership Analysis |

| Analyst Recommendations | Analyst Opinions |

| Industry Peer Comparison | Industry Benchmarking |

| Product Pipeline | Future Prospects |

| Market Penetration | Competitive Position |

| Environmental, Social & Governance | ESG Performance |

Technical Analysis

Technical analysis is a method that focuses on analyzing historical price patterns, trends, and trading volumes to predict a stock’s future price movements. Investors use various technical indicators and chart patterns to identify entry and exit points for their trades.

For example, Bob wants to invest in a tech company called “InnovateNow.” He uses technical analysis tools, such as moving averages, relative strength index (RSI), and candlestick patterns, to study InnovateNow’s stock price history. Based on his analysis, Bob identifies a potential buying opportunity and decides to invest in the company.

We will explore key points that should be considered during a comprehensive technical analysis. These points cover different categories such as trend analysis, momentum indicators, price patterns, and more. A strong grasp of these factors will enable traders to effectively analyze market data and make well-informed trading decisions.

| Points | Category |

|---|---|

| Price Trends | Trend Analysis |

| Support and Resistance Levels | Trend Analysis |

| Moving Averages | Trend Analysis |

| Moving Average Convergence/Divergence (MACD) | Momentum Indicators |

| Relative Strength Index (RSI) | Momentum Indicators |

| Stochastic Oscillator | Momentum Indicators |

| Bollinger Bands | Volatility Indicators |

| Average True Range (ATR) | Volatility Indicators |

| Fibonacci Retracements | Price Patterns |

| Chart Patterns | Price Patterns |

| Candlestick Patterns | Price Patterns |

| Elliott Wave Theory | Price Patterns |

| Volume Analysis | Volume Indicators |

| On-Balance Volume (OBV) | Volume Indicators |

| Accumulation/Distribution Line (ADL) | Volume Indicators |

| Market Breadth | Market Sentiment |

| Advance-Decline Line (AD Line) | Market Sentiment |

| Arms Index (TRIN) | Market Sentiment |

| Put/Call Ratio | Market Sentiment |

| Pivot Points | Support & Resistance |

| Gann Theory | Trading Techniques |

| Ichimoku Cloud | Trading Techniques |

| Keltner Channels | Volatility Indicators |

| Parabolic SAR | Trend Analysis |

| Rate of Change (ROC) | Momentum Indicators |

| Time Series Analysis | Statistical Techniques |

| Seasonality | Statistical Techniques |

| Linear Regression | Statistical Techniques |

| Detrended Price Oscillator (DPO) | Price Oscillators |

| Donchian Channels | Volatility Indicators |

Quantitative Analysis

Quantitative analysis involves using mathematical and statistical models to analyze large datasets and make investment decisions. This method can help investors identify trends, patterns, and relationships that may not be apparent through other types of analysis.

Imagine Alice wants to diversify her portfolio by investing in a group of companies within the same industry. She uses quantitative analysis to create a model that considers factors like revenue growth, profit margins, and debt levels. Based on her analysis, she identifies the top-performing companies in the industry and decides to invest in them.

We will explore key points that should be considered during a comprehensive quantitative analysis. These points cover different categories such as statistical techniques, risk analysis, performance evaluation, investment strategies, and more. A thorough understanding of these factors will enable investors to effectively analyze complex financial data and make well-informed investment decisions.

| Points | Category |

|---|---|

| Probability Distributions | Statistical Techniques |

| Descriptive Statistics | Statistical Techniques |

| Inferential Statistics | Statistical Techniques |

| Hypothesis Testing | Statistical Techniques |

| Regression Analysis | Statistical Techniques |

| Time Series Analysis | Statistical Techniques |

| Monte Carlo Simulation | Simulation Techniques |

| Optimization Techniques | Mathematical Techniques |

| Sensitivity Analysis | Risk Analysis |

| Scenario Analysis | Risk Analysis |

| Risk-Adjusted Performance Metrics | Performance Evaluation |

| Alpha | Performance Evaluation |

| Beta | Performance Evaluation |

| Sharpe Ratio | Performance Evaluation |

| Sortino Ratio | Performance Evaluation |

| Treynor Ratio | Performance Evaluation |

| Information Ratio | Performance Evaluation |

| Factor Models | Investment Strategies |

| Smart Beta Strategies | Investment Strategies |

| Portfolio Construction | Portfolio Management |

| Portfolio Optimization | Portfolio Management |

| Diversification | Portfolio Management |

| Asset Allocation | Portfolio Management |

| Risk Parity | Portfolio Management |

| Modern Portfolio Theory (MPT) | Theoretical Framework |

| Efficient Market Hypothesis (EMH) | Theoretical Framework |

| Behavioral Finance | Theoretical Framework |

| Algorithmic Trading | Trading Techniques |

| High-Frequency Trading (HFT) | Trading Techniques |

| Machine Learning | Artificial Intelligence (AI) |

So, Stock analysis techniques like fundamental analysis, technical analysis, and quantitative analysis can help investors make informed decisions about their investments.

Each method has its strengths and limitations, and investors may use a combination of these techniques to achieve their financial goals. By learning and applying these methods, Alice and Bob were able to make well-informed investment decisions and grow their portfolios confidently.

we have provided you with an overview of the stock market, guiding you through the initial steps of your investment journey. However, it is essential to understand that the Share market is like an ocean, vast and ever-changing, without a fixed syllabus. To master it, you must continually stay updated with market trends and developments.

Having read this article, you are now equipped to begin your Share market journey. However, remember that this is only the beginning, as there is so much more to learn and explore in the world of investing.

The Share market is a dynamic and exciting realm, and with dedication, patience, and constant learning, you can navigate it successfully. Keep in mind that this is just the start – the rest of the picture is yet to unfold.

Remember, knowledge is power, and the more you know about the Share Market, the better decisions you can make about your investments. Happy learning Form Sharedhan!